There are some who say that Dr Mahathir ismain wayang and is pretending he is not pleased that Ananda Krishnan gave 1MDB a RM2 billion loan. And this is because Ananda Krishnan would never do anything that Dr Mahathir does not want him to do — especially to help save 1MDB. But then Dr Mahathir also could not afford for Ananda Krishnan to be extradited to India and eventually put in jail. So giving 1MDB a loan of RM2 billion is a small price to pay to save Ananda Krishnan.

Raja Petra Kamarudin

According to Forbes, Tatparanandam Ananda Krishnan’s net worth is estimated at RM44 billion as at May 2015 and he is the sixth richest man in Asia.

Ananda Krishnan’s stunning multi-million dollar Kia Ora homestead on a 1,800-hectare piece of land near the rural town of Scone, about 330km from Sydney, won the prestigious 2006 Housing Industry Association Hunter Home of the Year Award.

Ananda Krishnan’s majestic Gulfstream IV, which he shares with Dr Mahathir and which is said to be jointly owned and half-paid by Petronas.

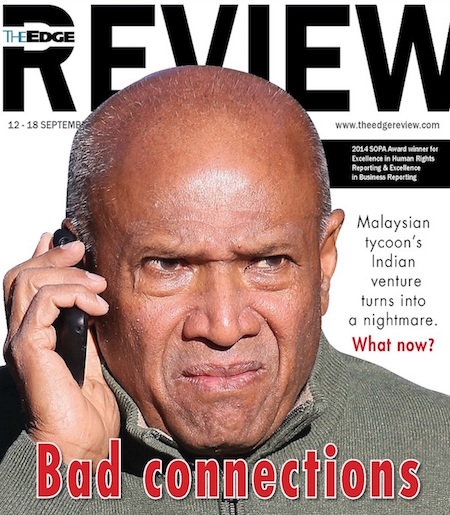

Well, every one knows how Tun Dr Mahathir Mohamad helped make T. Ananda Krishnan rich by milking Petronas. What many do not know is that he transferred billions of his wealth to India to finance a shady deal.

But then he got caught and now the Indian government wants him arrested and charged, and most likely jailed. And the only person who can save his sorry ass is Prime Minister Najib Tun Razak.

And that is why Ananda Krishnan gave 1MDB a loan of RM2 billion a year ago, much to the chagrin of Dr Mahathir. The old man wanted 1MDB to default on its loan repayments. Ananda Krishnan, however, wanted to curry favour (pun intended) with the Malaysian government. And this did not quite fit in to Dr Mahathir’s plans.

There are some who say that Dr Mahathir ismain wayang and is pretending he is not pleased that Ananda Krishnan gave 1MDB a RM2 billion loan. And this is because Ananda Krishnan would never do anything that Dr Mahathir does not want him to do — especially to help save 1MDB. But then Dr Mahathir also could not afford for Ananda Krishnan to be extradited to India and eventually put in jail. So giving 1MDB a loan of RM2 billion is a small price to pay to save Ananda Krishnan.

And that is the normal modus operandi of Dr Mahathir. You never really know what he is up to. He can tell his people to do one thing and then pretend he is not happy about it. It was just like when Dr Mahathir told Anwar Ibrahim to oust Tun Ghafar Baba and then pretended that he is not pleased with it.

Anyway, read below what Savio Rodrigues ofGoa Chronicles has to say about Ananda Krishnan’s mess in India. And without the protection of the Malaysian government Ananda Krishnan might find himself extradited to India where he is going to spend the rest of his days in jail. And if Dr Mahathir continues to harass Najib, Ananda Krishnan might just find his goodwill with the government wearing off.

***********************************************

For starters let’s take the investigations of CBI on the Maxis-Aircel deal. The Marans have been alleged to have received gratification for facilitation of a juicy telecom deal in the buy-out of Aircel Limited for the Maxis Communication Berhad organisation owned by the powerful business tycoon from Malaysia, T Ananda Krishan – a Malaysian on Sri Lankan Tamil origin. So far CBI has failed to question charge sheeted T Ananda Krishnan and Augustus Ralph Marshall (one of the Directors on several companies of Krishnan) in the Maxis-Aircel scam. CBI has listed them in the charge sheet for the offences punishable under section 120-B (criminal conspiracy) of the IPC and under relevant provisions of the Prevention of Corruption Act.

The court issued fresh summons in March 2015 to the four other accused, Malaysian business tycoon T Ananda Krishnan, Augustus Ralph Marshall and two accused firms after the CBI expressed its failure to issue summons against them in October 2014. However, the inability of CBI to investigate Krishnan and Marchall continues on account of the slow process of the Indian government exerting pressure on the Malaysian government through diplomatic channels.

CBI is investigating T Ananda Krishnan, Augustus Ralph Marshall and their companies Maxis Communication Berhard, South Asia Entertainment Holding and Astro All Asia Network PLC for their alleged role in the corruption Maxis-Aircel scam. Maxis Communications Berhad between 2007 and 2009 bought 20 per cent Kalanithi Maran – owned Sun TV Network Ltd through its subsidiaries Astro All Asia Network and South Asia Entertainment Network for Rs 599.01 crore.

CBI had filed the charge sheet in the case containing the names of 151 prosecution witnesses and a set of 655 documents, on which it has relied upon during its probe. The case involves investigation in foreign countries and in its submission in Court stated that there were sufficient grounds to proceed against the accused named in the charge sheet.

So far, the Centre through its diplomatic channels has not been able to convince the Malaysian government – even though both countries have signed a Mutual Legal Assistance Treaty (MLAT) – to cooperate with the Indian government in these serious allegations of corruption. For months the CBI have not been able to issue summons to the accused from Malaysia, compare that to the cooperation extended from the Mauritius government on investigating the Global Communications Services Holdings Limited (GCSHL) – a Maxis Communication Berhard company – under which the entire intricate buy-out of Aircel took place.

GCSHL bought out 65 per cent in Aircel Limited and 25.17 per cent in Deccan Digital Works (a company owned by the Reddy-family that owns the majority stake in the Apollo Hospitals Enterprises). Deccan Digital Works – in whose board now sits Sandip Das (CEO, Maxis Communication Berhad) then bought out 35 per cent of Aircel Limited. The Aircel Limited then went and acquired 100 per cent of Aircel Cellular Limited and Dishnet Wireless Limited.

The business deal gave Maxis Communication Berhard a 99.3 per cent holding in Aircel Limited at a time when Foreign Direct Investment (FDI) in the Indian Telecom sector was capped at 74 per cent in the year 2006 (0.7 per cent in owned by Sivasankaran, the previous owner of Aircel Limited. UPA government opened doors to 100 per cent FDI in the Telecom sector in 2013.

In March 2006, the Maxis Group owned T Ananda Krishnan, bought 74 per cent stake in Aircel, through different companies. The company soon got FIPB approval in May 2006.

In November 2006, the Department of Telecommunications (DoT) issued to Aircel 14 Letters of Intent, which were all converted into licenses in December 2006. Within three months of this development, Maran’s family owned business (Sun Direct) received substantial investments from the Maxis Group (now owners of Aircel), which took 20 per cent equity of the Maran company. The FIPB approved this investment too on March 2 and 19, 2007. The Maxis group invested a total of Rs 599.01 crore in Sun Direct between December 2007 and December 2009.

In 2007, Malaysia’s Astro Malaysia Holdings (AMH) bought a sizeable chunk of shares at a premium, in the privately-held Maran Group Company, Sun Direct, and South Asia FM Ltd, a subsidiary of the BSE-listed Sun TV Network Limited.

AMH channeled its investment through its subsidiary Astro All Asia Networks, which in turn, routed money through the step-down subsidiary, South Asia Entertainment Holdings Ltd. The investment, cleared through the FIPB route, was in fact hailed by all the business dailies. In fact AHM also acquired stake in NDTV Good Times.

AMH is a subsidiary of Maxis. Both companies are controlled through its holding company Binariang GSM SDN BHD (Malaysia) owned by T Ananda Krishnan – a Malaysian Tycoon of Sri Lankan Tamil origin.

Saudi Telecom Company (STC) bought out 25 per cent of Binariang GSM SDN BHD (Malaysia) for an astonishing USD3.05 Billion in 2007. As STC now owns a quarter of Maxis, it would also hold an equivalent stake in Maxis’ India operations. STC said in a statement that it had entered the telecom markets of India, Malaysia and Indonesia with the 3.05 billion dollar investment. The statement quoted STC chairman Muhammad Bin Suliman Al-Jasser as saying: “We will expand our footprint to over 1.4 billion people in these countries.”

Interestingly, T Ananda Krishnan’s close associate and co-accused in the CBI charge sheet Augustus Ralph Marshall was a No. 2 most wanted man in Indonesia. The Indonesian Police put Marshall on the Wanted Persons List after it was established that he was a suspect in a case of criminal forgery while he was involved with Astro’s Indonesian venture. Marshall had earlier been accused of forging documents that resulted in some US$90 million (RM270 million) in losses to Astro’s then partner in Indonesia PT Ayunda Prima Mitra.

CBI in Court has claimed that a politically and economically powerful person from Malaysia is stalling the foreign investigations into T Ananda Krishnan’s companies on the Maxis-Aircel scam. It should not come as a surprise to them that Krishnan is a highly influential person in Malaysia and globally as well. He also has the backing of the powerful Saudi Telecom Company who has ambitious plans in the Indian sub-continent and Asia. Besides lack of cooperation from Malaysia, CBI must also tell the people of India, who are the present and past political leaders who have been exerting pressure to go slow on the Malaysia investigations.

It makes me wonder if money is the only catalyst to have glued T Ananda Krishnan and former Congress Minister Murasoli Maran sons Kalanithi and Dayanidhi, or the Tamil connection or could it be – political ideology.

Savio Rodrigues, Goa Chronicles(http://goachronicle.com/this-is-india-marans-will-go-scot-free-part-1/)

***********************************************

Here is the detailed structure on how Maxis Berhad Communications acquired 99.3 of Aircel Limited right under the watchful eyes of UPA government in 2008, even though 100 Foreign Direct Investment (FDI) in Telecom sector was opened only in 2012

Maxis own 100 per cent of Global Communications Services Holdings Ltd (Mauritius). GCH owns 65 per cent of Aircel Limited and 25.17 per cent of Deccan Digital Works (Reddy & Maxis CEO Sandip Das Directors). Deccan Digital Works owns 35 per cent in Aircel Limited.

Aircel Limited own 100 per cent Aircel. Cellular Ltd and 100 per cent Dishnet Wireless. GCH also owns 100 per cent of South Asia Communications Pvt Ltd.

In March 2006, the Maxis Group owned T Ananda Krishnan, bought 74 per cent stake in Aircel, through different companies. The company soon got FIPB approval in May 2006.

In November 2006, the Department of Telecommunications (DoT) issued to Aircel 14 Letters of Intent, which were all converted into licenses in December 2006. Within three months of this development, Maran’s family owned business (Sun Direct) received substantial investments from the Maxis Group (now owners of Aircel), which took 20 per cent equity of the Maran company. The FIPB approved this investment too on March 2 and 19, 2007. The Maxis group invested a total of Rs 599.01 crore in Sun Direct between December 2007 and December 2009.

In 2007, Malaysia’s Astro Group bought a sizeable chunk of shares at a premium, in the privately-held Maran Group Company, Sun Direct, and South Asia FM Ltd, a subsidiary of the BSE-listed Sun TV Network Limited.

Astro Group channeled its investment through its subsidiary Astro All Asia Networks, which in turn, routed money through the step-down subsidiary, South Asia Entertainment Holdings Ltd. The investment, cleared through the FIPB route, was in fact hailed by all the business dailies.

Astro is a subsidiary of Maxis. Both companies are controlled through its holding company Binariang GSM SDN BHD owned by T Ananda Krishnan – a Malaysian Tycoon of Sri Lankan Tamil origin.

So far due to the failure of the Indian government to exert its diplomatic channels with the Malaysian government to allow for CBI to find a trial between the Mauritius company and Malaysian companies owned by T Ananda Krishnan. This vital piece in the scam has still not been investigated in totality.

Savio Rodrigues, Goa Chronicles(http://goachronicle.com/the-maran-conundrum-stock-options-political-chutzpah/)

%20bergaya.webp)