Malaysians need to understand that the Goods and Services Tax (GST) that is likely to be implemented in 2015 is a modified version, with the inclusion of a zero rate and exempt items, as well as a sales threshold, as found in most countries.

Former professor of Applied Economics and Dean of Faculty of Economics and Administration, Universiti of Malaya Tan Sri Dr Fong Chan Onn explained, the modified GST that is to be adopted by Malaysia will allow for some 40 basic food necessities to be listed as zero tax items, including rice, sugar, milk powder and flour, while essential services, such as healthcare, may be classified as tax-exempt.

“At a personal level, through the modified GST the public can decide for themselves whether to pay consumption taxes when dining out or avoid tax payments by preparing their own meals with essential items that are exempt from the GST,” he told Bernama here.

The GST will replace the 16 per cent sales and services tax (SST) now levied on certain goods and services, such as food and beverages in restaurants and hotel services. Presently, much of the public does not realise that even those who are not required to pay income tax still pay sales taxes and service taxes on goods and services they consume through the SST.

This is because most consumers are not aware that the tax has been embedded in the price of goods and services sold by retailers.

That is why some economists point out that since most items are already being taxed under SST, the transition from SST to GST will ease the burden on the poor, as some items they purchase would become zero tax items.

In principle, GST is supposedly a regressive tax, since it is imposed on all goods and services produced in the country, including imports.

However, as explained by Deputy Head of the School of Business, Monash University of Malaysia Prof Jeyapalan Kasipillai, there are ways to mitigate the tax burden faced by middle and lower income groups, as well as small businesses.

“Essential supplies of over 40 items would be either zero-rated or exempted, and such a move would be favourable to the broader community, particularly the lower income groups,” he wrote in an article published in a local newspaper on Oct 19. Zero-rated goods and services are those items that have no tax charged to consumers, which means the consumer will pay GST at the rate of zero per cent. He said based on the data compiled from the Household Expenditure survey (HES), which collates information on levels and trends of consumption expenditures by households on a wide range of goods and services, the finding suggest that GST can be fairly progressive.

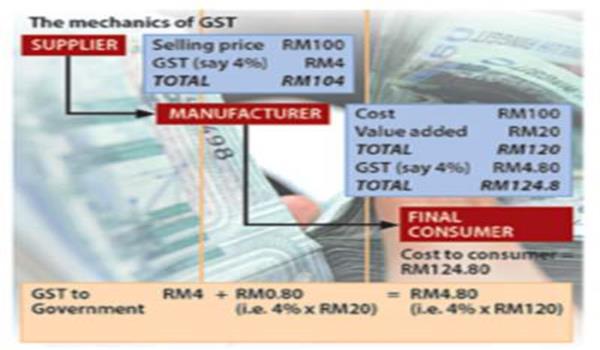

Some analysts have predicted that the new tax is likely to start at four per cent, and may later rise to six per cent.

Malaysia is among the last ASEAN countries, together with Myanmar and Brunei, that has not implemented the GST. Indonesia introduced the GST in 1985, Thailand in 1992 and Singapore in 1994. Dr Fong also explained that GST, a broad-based consumption tax or value added tax, is part of the fiscal reforms undertaken by the government to reduce deficits and achieve a balanced budget by 2020. This would serve as more broad-based revenue collection system that will greatly expand the number of taxpayers as the fairest method of taxing the general public.

Currently, only 1.7 million of the country’s 29 million citizens pay income tax. With GST in place, there is no doubt that there will be differences in how Malaysians spend. First, they will be calculating the tax, then evaluating it as to whether a purchase is worthwhile.

Then, if consumers do not feel the purchase is needed at the price asked, they will either seek a less expensive alternative or choose not to continue with the purchase.