Strategis PPBM “Rais Hussin berkata GST di India jauh lebih baik dan lebih baik daripada Malaysia.

Beliau menulis di Mkini:

“Items taxed at 28 percent are things like ATM machines, which are bought and used by banks. In other words, those who pay 28 percent GST are mostly those who can afford it. India’s GST was introduced to shield the poorest from the worst effects of the tax.”

Wah.. Mesin ATM … ? ? ? ..

Rais Hussin ini menulis 99% tidak masuk akal.

Malah, orang-orang Cap Bunga tidak keberatan untuk memfitnah dengan memberikan maklumat yang mengelirukan.

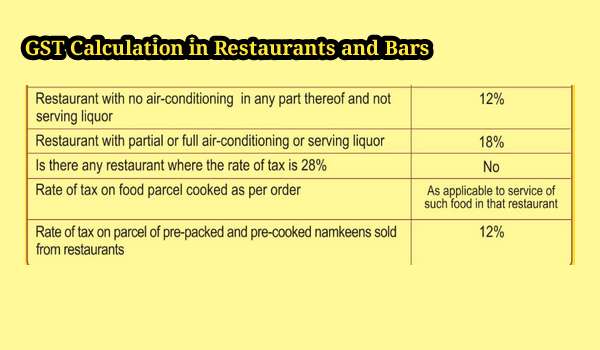

Mari kita lihat apa yang dikenakan cukai dan mengikut kadar GST di India.

————————-

*India -12% GST*

Goods

Frozen meat products, butter, cheese, ghee, dry fruits in packaged form, animal fat, sausage, fruit juices, namkeen and ketchup & sauces will attract 12 per cent tax.

Cellphones will also be priced in this category. Cutlery items like Spoons, forks, ladles, skimmers, cake servers, fish knives, tongs fall in this slab.

Ayurvedic medicines and all diagnostic kits and reagents are taxed at 12 per cent.

Utility items like tooth powder, umbrella, sewing machine and spectacles and indoor game items like playing cards, chess board, carom board and other board games like ludo are in this slab.

Clothing above Rs 1000 (RM66) will attract 12 per cent tax.

Services

Non-AC hotels, business class air ticket, state-run lottery, work contracts will fall under 12 per cent GST tax slab

——————-

*18% GST in India*

Goods

Biscuits, flavoured refined sugar, pasta, cornflakes, pastries and cakes, preserved vegetables, jams, sauces, soups, ice cream, instant food mixes, curry paste, mayonnaise and salad dressings, mixed condiments and mixed seasonings and mineral water.

Footwear costing more than Rs 500 (RM33) are in this category.

Items like Printed circuits, camera, speakers and monitors, printers (other than multi function printers), electrical transformer, CCTV, optical fiber are priced at 18 per cent tax under GST.

Other items in this slab include bidi leaves, tissues, envelopes, sanitary napkins, note books, steel products, kajal pencil sticks, headgear and its parts, aluminium foil, weighing machinery (other than electric or electronic weighing machinery), bamboo furniture, swimming pools and padding pools.

Services

AC hotels that serve liquor, telecom services, IT services, branded garments and financial services will attract 18 per cent tax under GST.

————————-

*28% GST in India*

Goods

The residuary set of edibles which include chewing gum, molasses, chocolate not containing cocoa, waffles and wafers coated with choclate, pan masala and aerated water fall in this category.

Bidi (tobacco) attracts 28 per cent tax.

An array of personal care items like deodorants, shaving creams, after shave, hair shampoo, dye and sunscreen are in the highest tax slab as well.

Paint, wallpaper and ceramic tiles are priced at 28 per cent.

Water heater, dishwasher, weighing machine, washing machine, ATM, vending machines, vacuum cleaner, shavers and hair clippers have been clubbed together in this slab.

Automobiles, motorcycles and aircraft for personal use will attract 28 % tax – the highest under GST system.

Services

5-star hotels, race club betting, private lottery and movie tickets above Rs 100 are under the 28 per cent category.

The GST on restaurants in five-star and luxury hotels has been reduced to 18 per cent from 28 per cent, bringing it at par with standalone air-conditioned (AC) restaurants.

Symber: